Thought of the Week - The biggest climate stress test so far

In the next couple of months, we expect to get the first official results from the biggest climate stress test in the world so far. The ECB, together with a host of other organisations has collected data from millions of EU companies in order to assess how big the impact of climate change would be on different sectors and on banks and insurance companies.

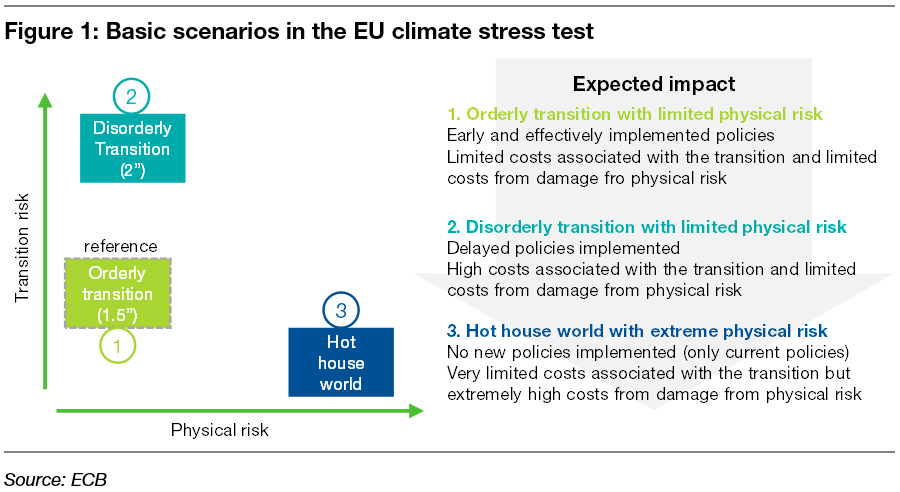

And, as you might imagine, the preliminary results of this stress test don’t look too good. As a base case the stress test works with a scenario of an orderly transition to a green economy that allows to keep the physical risks from climate change limited and provides an orderly, gradual adaptation for the economy. It then compares this base case scenario with the scenario of a sudden disorderly transition where regulation remains unchanged for longer and then suddenly, when the proverbial s… hits the fan, regulations get tightened very quickly and the transition to a green economy has to be made in a short period of time. And it compares the orderly transition with a “hot house scenario” of doing nothing.

The preliminary results show that it is in the best interest of investors, banks, and businesses to do something now because the sooner regulation is changed and, for example, the price of carbon is increased the lower the bankruptcy risks for businesses.

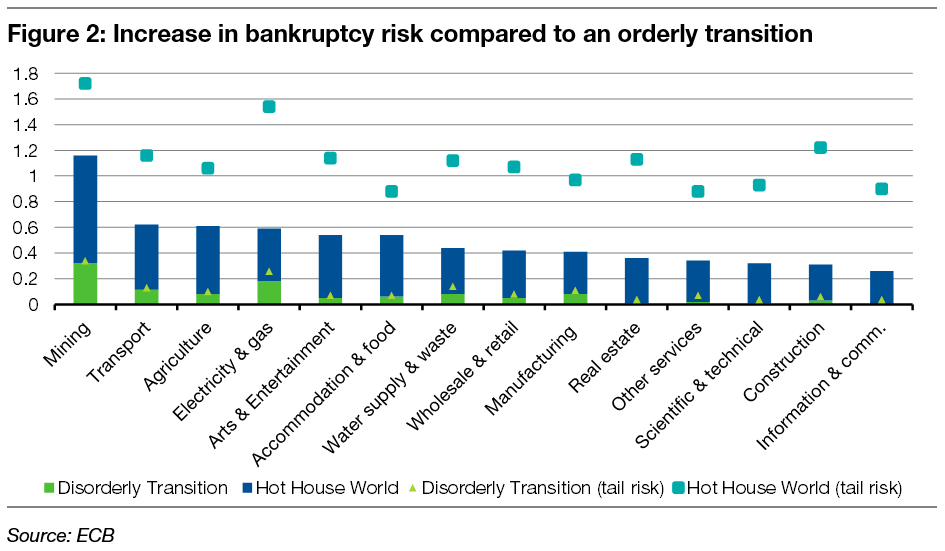

The chart below shows the increase in bankruptcy risks for different sectors for the two stress test scenarios compared to the orderly transition scenario. For the hot house world of doing nothing, bankruptcy risks rise by 25% or so even for the IT sector, and for the mining sector it increases by almost 120%. And that is not even the tail risk but the average expected increase in defaults.

Banks will obviously be very hard hit if default rates increase materially in individual sectors, so the most interesting thing for me to look for are the results of the impact on bank loan books and balance sheets. These results will likely also influence the ECB, which is playing with the idea of forcing banks to lend more to green projects. This, I find a very dangerous and quite frankly counterproductive idea because directing the use of credit and money has been tried in the past and failed every time. But it seems the ECB is willing to go down this road once more based and the ECB stress tests will guide its decisions. So keep looking for these results scheduled to be published in mid-2021.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.