Thought of the week – Greenwashing with green bonds

A couple of months ago, I read an analysis of around 1,000 green bonds issued by governments and corporations. It made me very angry. Unlike sustainability-linked loans and bonds, which are general purpose bonds, the Green Bond Principles require that the proceeds from issuing such bonds are ringfenced and used for eligible green projects. Yet, it seems that the lawyers have done a great job in negating the very essence of the Green Bond Principles and turned them into another exercise of greenwashing.

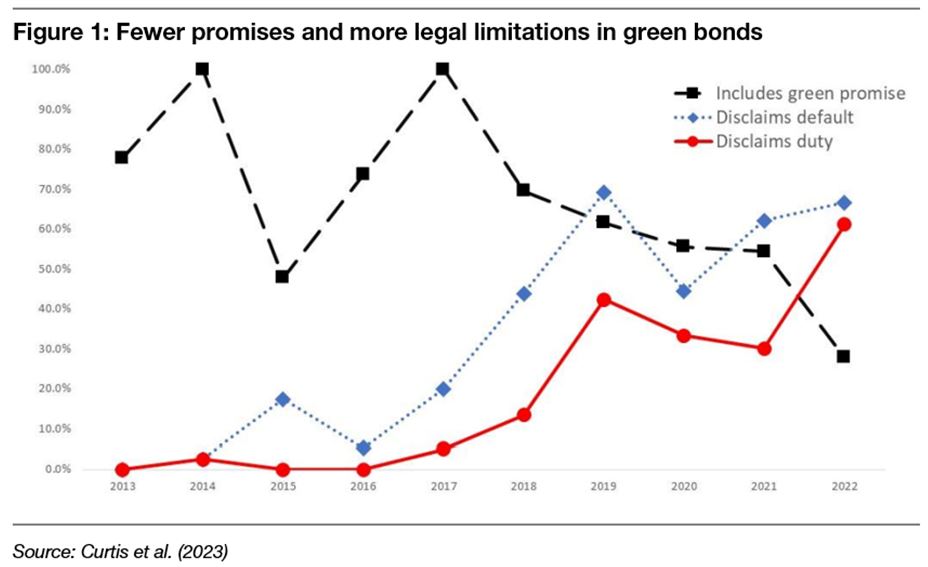

The study by Quinn Curtis and his colleagues looked at the kind of green promises that were made in the prospectuses of green bonds (what will the proceeds be used for) and the kind of disclaimers (if any) to limit legal liability in case these promises are broken. The chart to the left summarises what infuriates me about the current practice of green bonds.

When green bonds were a new thing, most, if not all of the newly issued bonds made green promises to use the proceeds for green projects. But since 2018, the share of newly issued bonds with such green promises has declined steadily and in 2022 dropped to a mere 27%. That is ridiculous. Any ‘green bond’ that excludes such promises would not survive an external audit for certification as a green bond. Yet, such certification and third-party audit is not mandatory, so any company or country can issue bonds and claim they are green bonds, when in fact they don’t even meet the basic criteria.

What is worse, look at the share of disclaimers that wave any liability of the issuer if the green promises that are made are violated. About two-thirds of all green bonds issued now have disclaimers that explicitly state that a breach of the promises to use the funds for green projects does not constitute an event of default. Similarly, two-thirds of newly issued green bonds have disclaimers that wave the duty of the issuer to invest the proceeds in these green projects.

In essence, over the last couple of years, green bonds have become nothing more than another exercise in greenwashing. They are making empty promises and investors cannot even hold the issuer accountable for using the funds in whatever way they deem useful. Green bonds are nothing more than a conventional bond with a nice shiny label attached. And that needs to stop. It should be easy to stop this abuse. Just make it mandatory for green bonds to be audited by third parties in conformity with the Green Bond Principles and amend the principles to explicitly state that a misuse of the funds raised by green bonds constitutes a default event.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.